The Ultimate Guide To Discovering Your Core Values

Do you sometimes feel adrift when making financial choices, unsure if your decisions truly reflect what matters most to you?

Understanding your personal values is key to making financial decisions that secure your future and bring genuine fulfillment. Embracing and identifying these values can transform your financial decision-making process. When your financial choices mirror your core beliefs, you create a harmonious and satisfying life.

When your values and financial decisions clash, it often results in stress, dissatisfaction, and instability. So today, let's delve into uncovering your personal values and using them to guide your financial decisions effectively.

By the end of this article, you'll have a clear roadmap for aligning your financial actions with your deepest values, leading to better financial health and greater personal satisfaction.

What You’ll Learn:

- Why understanding your personal values is essential for better financial decisions.

- How misalignment between values and financial actions leads to stress and dissatisfaction.

- How identifying and incorporating your values into financial planning enhances fulfillment and stability.

- Practical steps to align financial decisions with values through self-reflection, strategic planning, and regular review.

Making Financial Decisions Without Understanding Personal Values

Many people struggle with financial decisions because they haven't identified their personal values. This often leads to choices that neither satisfy nor support their long-term goals, resulting in regret, stress, and instability.

Consider Steve Jobs. He left Apple in 1985 to start NeXT. Despite setbacks, he stayed true to his values of innovation and excellence. His persistence led to his successful return to Apple and the creation of groundbreaking products.

Contrary to popular belief, focusing solely on financial gain without considering personal values can yield significant success and wealth. However, this approach often leads to a lack of personal fulfillment and increased stress. Many Wall Street executives achieve substantial financial success but report high levels of stress and low job satisfaction.

Misalignment Between Personal Values and Financial Decisions

A lack of clarity about personal values often drives people to chase financial goals that don’t truly satisfy them. Many follow societal norms and expectations without reflecting on what genuinely matters to them.

Other contributing factors:

- Societal pressure often leads to adopting external values.

- A lack of introspection prevents identifying true values.

- Financial education rarely focuses on personal values.

To make better financial decisions, individuals must uncover and align their personal values with their financial actions. This alignment leads to more meaningful and satisfying financial outcomes.

Exercises to Help You Be Clear with Your Personal Values

1. Shalom Schwartz's Theory of 10 Universal Values

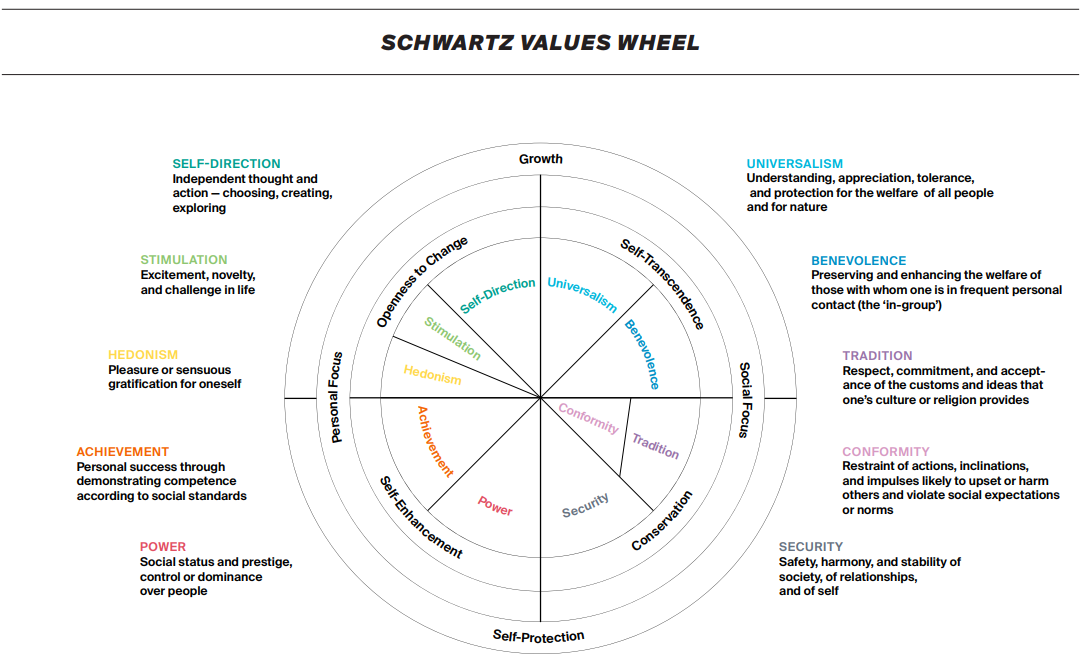

Shalom Schwartz, a renowned psychology professor, unveiled a groundbreaking theory identifying ten universal personal values. These values, applicable across diverse cultures, form the foundation of his work. Collaborating with over 150 researchers, Schwartz's theories and methods have been applied in more than 80 countries, showcasing their global relevance.

The framework he devised consists of ten overarching value themes and 57 individual values, each fundamental to human motivation. Schwartz’s theory doesn’t just list values; it organizes them into a motivational continuum. Adjacent values support and complement each other, creating harmony. Conversely, values on opposite ends of the spectrum clash, highlighting inherent conflicts in human motivation.

Schwartz’s work not only maps out these values but also explains their intricate relationships, offering profound insights into what drives us as individuals and societies.

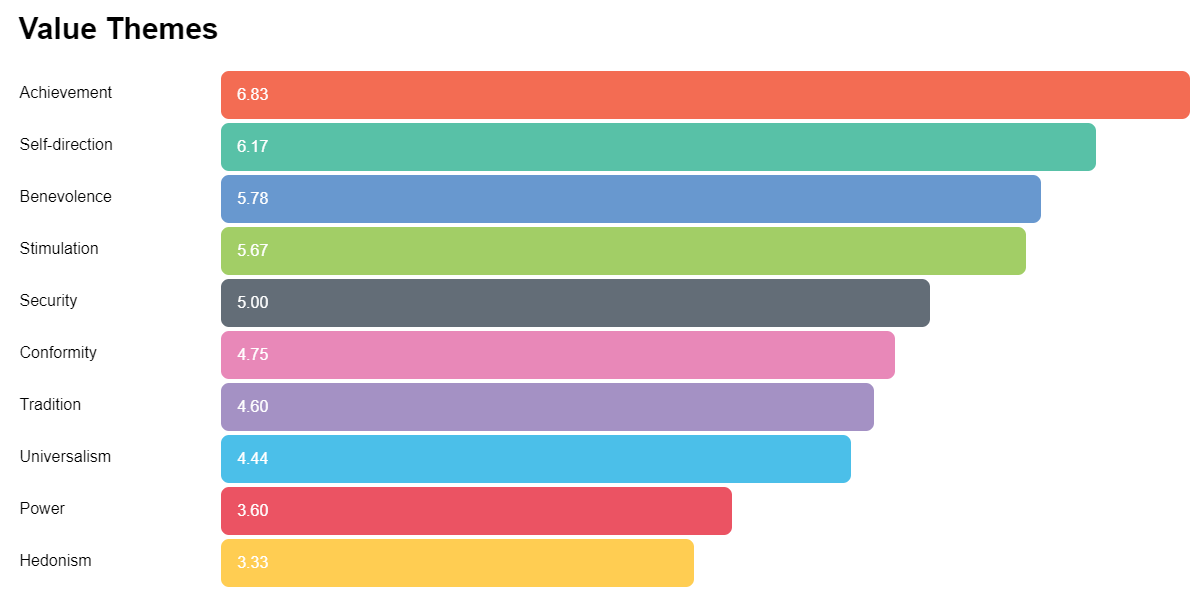

Here are my core values based on the assessment from DiscoverYourValues.com

Take your free Personal Values Assessment here.

2. The VIA Institute on Character

The VIA Survey is the another free, scientific survey of character strengths in the world. Take this simple, 10 minute character test and discover your greatest strengths.

I took mine in 2019.

Lastly, if you want a deep, reflective questions that you can do during the weekend.

3. The Top 5 Questions to Uncover Your Personal Values

- What moments in your life have made you feel truly happy and fulfilled?

- This question helps identify experiences and activities that align with one's core values, as true happiness often reflects our deepest values.

- This question helps identify experiences and activities that align with one's core values, as true happiness often reflects our deepest values.

- Who do you admire most and what qualities do they have that you wish to embody?

- The traits we admire in others often mirror the values we aspire to uphold ourselves, making this an insightful question to understand personal ideals.

- The traits we admire in others often mirror the values we aspire to uphold ourselves, making this an insightful question to understand personal ideals.

- When you face a tough choice, what criteria do you use to make your decision?

- Understanding the factors that influence decision-making can reveal underlying values that guide one's choices, especially in difficult situations.

- Understanding the factors that influence decision-making can reveal underlying values that guide one's choices, especially in difficult situations.

- If money was no object, how would you choose to spend your time daily?

- This question helps to strip away practical constraints and focuses on pure interest and passion, highlighting values free from external pressures.

- This question helps to strip away practical constraints and focuses on pure interest and passion, highlighting values free from external pressures.

- What kind of legacy do you want to leave behind?

- Considering one's legacy tends to bring core values into sharp focus, as it encapsulates the long-term impact and the mark one wishes to make on the world.

Once you’re clear with your values..

- Reflect on significant financial decisions and evaluate their alignment with your values.

- Develop a financial plan that incorporates your values into your spending and investing.

- Regularly review and adjust your financial plan to ensure continued alignment with your evolving values.

Aligning financial decisions with personal values nurtures a meaningful and satisfying life, contributing to long-term financial stability and personal fulfillment.

By understanding and incorporating your personal values into your financial decisions, you can create a life that is not only financially secure but also deeply fulfilling.

To your intentional life,

Kuya Jay

👋🏽Whenever you’re ready, here are two ways I can help you:

- Craft Your Own Financial Roadmap: Get access to an easy-to-follow financial planning tool, a series of video courses to help you craft your own financial plan and an exclusive community of like-minded individuals who want to manage their finances better! More about that here

- 1-on-1 Personalized Coaching: A three-session coaching program where we’ll discuss your financial goals, build your own money management system, improve your money habits and guide you on how to invest on your own. Learn more here.

Subscribe today.

Thank you for subscribing!

Have a great day!